Financial literacy is defined as the integration of awareness, knowledge, skills, attitudes, and behaviours that enable individuals to make informed financial decisions and achieve financial stability.

It combines financial understanding with real-world application, such as managing monthly income, preventing high-interest debt, and building long-term savings plans.

According to the Organisation for Economic Co-operation and Development (OECD) in its 2020 International Survey of Adult Financial Literacy, only one in three adults worldwide possesses adequate financial literacy, with those aged 18–29 ranking the lowest in both knowledge and behaviour.

This trend suggests that tech-savvy youth are not always money-smart.

The Growing Challenge Among Youth

Bank Negara Malaysia disclosed that Malaysia’s household debt-to-GDP ratio reached about 84% by the end of 2023, ranking among the highest in Asia.

Though this indicates wider access to financing, it also underscores a concerning trend: many young adults rely on credit cards, personal loans, or hire-purchase schemes despite lacking financial stability.

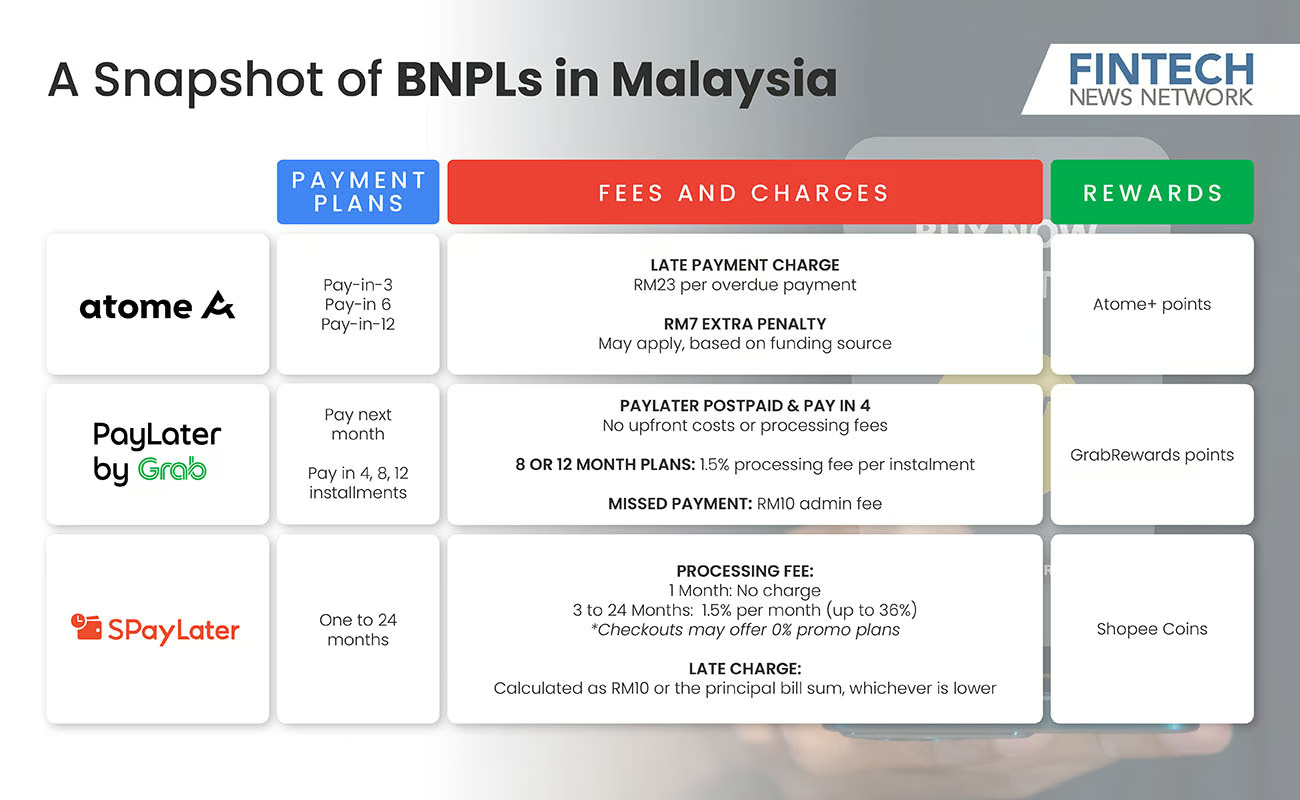

At the national level, Buy-Now-Pay-Later (BNPL) platforms have become a dominant trend in payments.

It has made borrowing easier for young people with limited financial experience.

When combined with slow wage growth and rising expenses, this access often drives young adults to borrow just to make ends meet.

Sarawak reflects similar financial behaviour patterns seen nationwide.

With more youth gravitating toward cities such as Kuching, Miri, and Bintulu, they encounter greater access to digital credit and consumer trends.

Without sufficient financial awareness, the mix of instant credit and peer influence can easily lead to overborrowing.

Understanding the Causes

Across Sarawak, a mix of technological and social factors is driving greater debt exposure among young people.

Firstly, the rapid expansion of digital financial services has made borrowing more convenient and accessible.

From mobile loan applications to Buy-Now-Pay-Later (BNPL) platforms, borrowing now takes only a few taps on a screen.

However, many users underestimate how multiple small instalments across platforms can accumulate into significant monthly commitments.

Secondly, behavioural patterns contribute significantly to the issue.

The Credit Counselling and Debt Management Agency (AKPK) found that poor spending control, weak saving habits, and limited financial planning are prevalent among young people.

Thirdly, economic conditions exacerbate these risks.

The Department of Statistics Malaysia (DoSM) recorded a youth unemployment rate of approximately 10.6% in 2023, surpassing the national rate.

With living costs rising and income growth stagnant, credit has become a coping mechanism rather than a financial tool for advancement.

Finally, financial literacy remains a major concern.

Although financial literacy is part of the national curriculum, its delivery often remains theoretical, with little emphasis on practical tools like budgeting or managing credit.

According to the OECD (2020), it emphasises that genuine financial competence develops through continuous, hands-on learning sustained over multiple years.

Read more :

References:

- OECD/INFE 2020 International Survey of Adult Financial Literacy

- A Total of 5,272 Youths Declared Bankrupt Since 2020

- Financial Capability and Inclusion Demand Side Survey 2024

- Labour Force Statistics Report

- AKPK – Advancing Prudent Financial Behaviour

- Getting into Debt at a Young Age as Part of a Lifecycle Phase: A Cause for Concern